Business Insurance in and around Marietta

One of Marietta’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

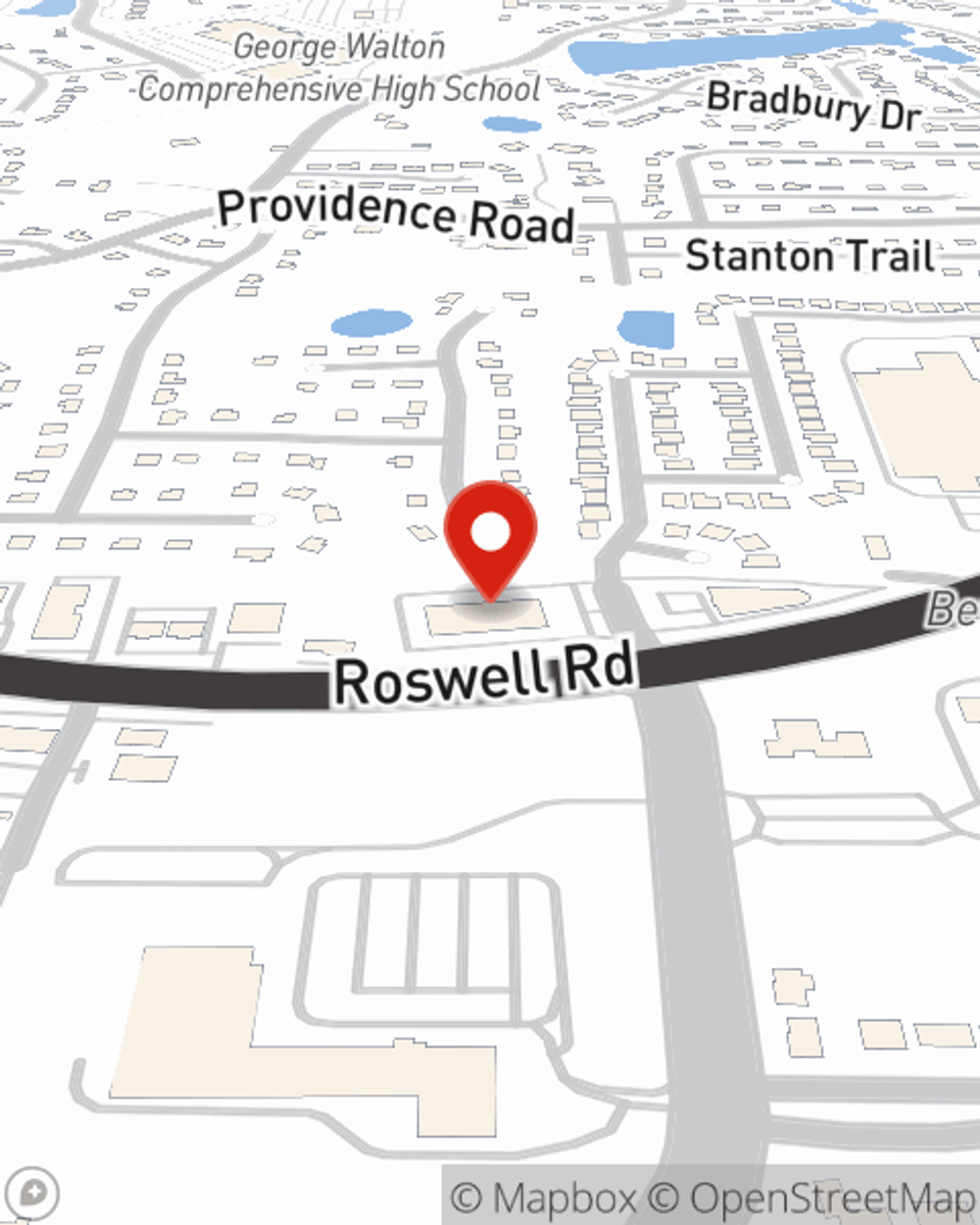

- Marietta

- Kennesaw

- Dallas

- Powder Springs

- Acworth

- Atlanta

- Cumming

- Canton

- Alpharetta

- Roswell

- Woodstock

- Dunwoody

- Austell

- Smyrna

- Sandy Springs

Your Search For Fantastic Small Business Insurance Ends Now.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Andrew Smith help you learn about great business insurance.

One of Marietta’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a piano tuner or a sporting goods store or you own a book store or a beauty salon. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Andrew Smith. Andrew Smith is the agent who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to learn more about your small business insurance options

It's time to contact State Farm agent Andrew Smith. You'll quickly spot why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Andrew Smith

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.